Blueprints, Bankruptcies & Beyond: Why CCRC Design Must Be More Than Cosmetic Fixes - Part 2

- Senior Living+Studio

- Jul 7, 2025

- 12 min read

Updated: Jul 7, 2025

This is Part 2 of our comprehensive series. Read Part 1 for the industry context and foundational research.

The Strategic Implementation Framework: From Theory to CCRC Design to Practice

In Part 1, we established the fundamental truth that design functions as financial infrastructure in successful CCRCs. We examined the stark contrast between industry bankruptcy fears and actual performance data, revealing that strategic design separates thriving communities from struggling ones. Now, we delve into the practical framework that transforms this understanding into measurable results.

The communities opening today will serve residents for fifty years or more. The design decisions made during planning and construction will either support or undermine financial performance for decades. This isn't hyperbole—it's mathematical reality backed by extensive industry data and real-world case studies.

Advanced Industry Intelligence: The Leadership Ecosystem

Understanding who drives innovation in CCRC design reveals the strategic pathways to excellence. The industry's most successful projects emerge from partnerships between visionary developers, evidence-based architects, and performance-focused capital managers. These collaborations consistently outperform projects driven solely by cost minimization.

The National Investment Center (NIC) tracks performance across 16,100+ senior housing communities, providing unprecedented insight into what works. Their quarterly occupancy and financial fundamentals data reveals clear patterns: communities designed with strategic intent achieve higher occupancy rates, command premium pricing, and maintain competitive advantages over decades.

Recent 2024 data showing 87.2% occupancy and record 618,000 occupied units demonstrates market strength, but dig deeper and the performance gap between strategic and conventional design becomes stark. Premium-designed communities consistently occupy the top quartile of performance metrics, while cost-minimized developments cluster in the bottom half.

The American Seniors Housing Association (ASHA) provides additional context through their annual rankings of largest owners and operators. Their industry research on resident attitudes and trends reveals shifting expectations that directly impact design requirements. Today's seniors expect hospitality-level experiences, integrated wellness programming, and technology-enabled convenience. Communities that anticipated these trends through strategic design now command waiting lists and premium pricing.

The American Institute of Architects (AIA) elevates the conversation through their Design for Aging Review, showcasing projects that merge aesthetic excellence with operational performance. Their 2023 winners include sustainable designs with regional materials and innovative programming models. More importantly, their Framework for Design Excellence provides measurable criteria for evaluating design success beyond traditional metrics.

The pattern emerges clearly: industry leaders understand design as strategic investment, not necessary expense. Their projects consistently achieve superior financial performance while creating environments that enhance resident satisfaction and staff retention. This isn't coincidence—it's the predictable result of evidence-based decision making.

The Evidence-Based Design Revolution

Strategic design begins with understanding that every spatial decision impacts financial performance. The most successful CCRCs implement what researchers call "evidence-based design"—incorporating passive climate response and daylighting with measurable health outcomes from initial programming through final occupancy.

Consider the financial impact of natural light optimization. Research demonstrates 15% reduction in antidepressant use among residents in properly daylighted spaces. This translates to measurable healthcare cost savings, reduced insurance claims, and improved family satisfaction scores. More subtly, residents in well-lit spaces demonstrate higher social engagement, leading to increased participation in fee-generating wellness programs and enhanced word-of-mouth marketing.

Energy performance represents another quantifiable benefit. Proper building orientation and fenestration design deliver 15-25% annual energy cost reduction compared to conventionally designed facilities. In a 200-unit community, this amounts to $75,000-125,000 annual savings—money that flows directly to operating margins or can support enhanced programming.

Staff retention provides perhaps the most dramatic example of design's financial impact. Well-designed work environments reduce staff turnover by 23% compared to functionally inadequate spaces. With skilled nursing wages averaging $28-32 per hour and turnover costs reaching $15,000-25,000 per position, design excellence pays for itself through reduced recruitment and training expenses.

The revenue diversification potential of strategic design extends far beyond basic occupancy fees. Forward-thinking communities create multiple income streams through thoughtful programming and space allocation. Wellness centers generate revenue through membership fees and specialized programs. Multi-purpose venues host external events and conferences. Retail partnerships with on-site services create additional income while enhancing resident convenience.

Market positioning represents the ultimate expression of design's financial power. Quality care and design premium supports 15-20% higher monthly fees compared to standard facilities. Entrance fee communities with award-winning design average $400,000 compared to $275,000 for conventional projects. This premium pricing reflects genuine value creation—residents and families willingly pay more for environments that enhance quality of life and provide superior care delivery.

The waiting list phenomenon demonstrates design's marketing power. Premium communities maintain 6-18 month waiting lists, providing financial stability and marketing leverage impossible to achieve through conventional approaches. These waiting lists represent captured demand that translates to immediate occupancy upon unit availability and reduced marketing costs per resident.

Financial Integration: The ROI Optimization Model

Strategic design requires financial planning integration from project conception through long-term operations. The most successful projects implement comprehensive ROI optimization frameworks that treat design decisions as capital investments requiring measurable returns.

Bundled procurement strategies exemplify this approach. Rather than segregating design, construction, and furnishing contracts, strategic developers coordinate purchasing to achieve 12-18% cost reduction compared to traditional approaches. Furniture, fixtures, and equipment coordination through single-source purchasing saves 15% compared to piecemeal buying while ensuring design coherence and warranty simplification.

Phased material procurement leverages bulk purchasing power across project phases, reducing costs 8-12% while maintaining design consistency. This approach requires sophisticated project management but delivers measurable savings that can fund enhanced programming or increased design budgets.

Technology integration represents a critical decision point where short-term cost savings often create long-term operational burdens. Smart building systems require $2-3 per square foot additional investment during construction but generate $0.50-0.75 annual operational savings through energy optimization and predictive maintenance capabilities. More importantly, residents increasingly expect integrated technology platforms, and retrofitting conventional buildings costs 3-4 times more than including infrastructure during initial construction.

Strategic capital planning prevents financial crises while optimizing long-term performance. Ten-year capital reserve planning requires $3,000-5,000 per unit annually but prevents emergency assessments and maintains competitive positioning. Preventive maintenance costs demonstrate a 4:1 ratio advantage over reactive approaches, while coordinated component replacement schedules save 20-25% compared to emergency replacements.

The sophistication required for this level of financial integration explains why successful CCRC development increasingly concentrates among experienced operators. The learning curve for optimizing design-financial integration spans multiple projects and requires organizational capabilities that extend far beyond traditional development expertise.

Advanced Case Study: The Strategic Design Dividend

Moving beyond Rose Villa's transformation story, let's examine a comparative analysis that quantifies strategic design's financial impact. Two hypothetical but realistic 250-unit communities illustrate the long-term consequences of design decisions made during initial development.

Community A represents strategic design investment: $85 million total development cost ($340,000 per unit) with 8% of budget allocated to design and planning versus industry standard 5%. The additional investment funds comprehensive programming, evidence-based design implementation, integrated technology infrastructure, and enhanced material specifications.

Community B follows cost-minimization approaches: $70 million total development cost ($280,000 per unit) with 3% budget allocation for design and planning. Standard programming, conventional layout solutions, basic technology, and value-engineered materials characterize this approach.

Year three performance data reveals dramatic differences. Community A achieves 94% occupancy with $4,200 average monthly revenue per unit, generating 23% operating margins compared to industry average 18%. Community B struggles to 82% occupancy with $3,600 average monthly revenue and 12% operating margins complicated by emerging capital needs.

The five-year financial impact compounds these differences. Community A delivers 8.4% annual return with stable performance trends and market leadership positioning. Community B faces $3.2 million in unplanned renovations, 15% staff turnover above industry averages, and declining competitive position as newer communities capture market share.

The cumulative revenue advantage reaches $12.8 million over five years—nearly enough to fund an entire additional project phase. This performance gap reflects not just occupancy differences but premium pricing power, reduced operating costs, enhanced resident satisfaction, and superior staff retention.

Perhaps most significantly, Community A builds strategic options for future expansion and market adaptation, while Community B struggles with legacy infrastructure that limits programming flexibility and technology integration. The strategic design investment creates durable competitive advantages that compound over time.

Implementation Excellence: The Phased Development Protocol

Successful strategic design implementation requires sophisticated project management spanning multiple years and coordinating numerous stakeholders. The most effective projects follow structured protocols that integrate market analysis, regulatory compliance, design development, and operational preparation.

The strategic foundation phase spans months 1-6 and establishes project parameters that influence all subsequent decisions. Market analysis extends beyond demographic projections to include lifestyle trend analysis, competitive intelligence, and regulatory landscape assessment. Regulatory compliance assessment for all jurisdictions requires legal expertise and design team coordination to ensure innovative programming meets safety and accessibility requirements.

Design team selection determines project potential more than any other single decision. The most successful projects pair developers with architects who demonstrate evidence-based design expertise, healthcare planning experience, and track records of financial performance excellence. Goal alignment sessions ensure all stakeholders understand performance expectations and measurement criteria.

Financial modeling during this phase must extend 20 years to capture design decisions' long-term impact. Pro forma development should include sensitivity analysis for occupancy rates, rental/fee escalation, capital expenditure requirements, and competitive positioning scenarios. This modeling reveals design investment opportunities that deliver measurable returns and identifies cost-cutting areas that undermine long-term performance.

Integrated design development consumes months 7-18 and transforms strategic vision into detailed implementation plans. Evidence-based design principles guide space programming, circulation patterns, and environmental systems selection. Technology infrastructure planning during this phase prevents costly retrofits and ensures resident expectations can be met through integrated platforms rather than add-on solutions.

Sustainability integration and certification pursuit require coordination between design team, engineers, and regulatory consultants. LEED certification and Energy Star programs provide marketing advantages and operational cost reduction while demonstrating commitment to environmental stewardship increasingly important to residents and families.

Community engagement and pre-sales strategy development during design phase creates market feedback loops that inform programming decisions while building anticipation for project opening. The most successful projects achieve 40-60% pre-sales before construction completion through strategic marketing that emphasizes design excellence and programming innovation.

Construction excellence spanning months 19-42 requires vigilant quality control and performance monitoring to ensure design intent translates to built reality. Staff training and operational preparation during construction ensures teams understand design features and can communicate value proposition to prospective residents. Technology system integration and testing prevents opening delays that can cost $10,000+ daily in staffing costs for ready facilities.

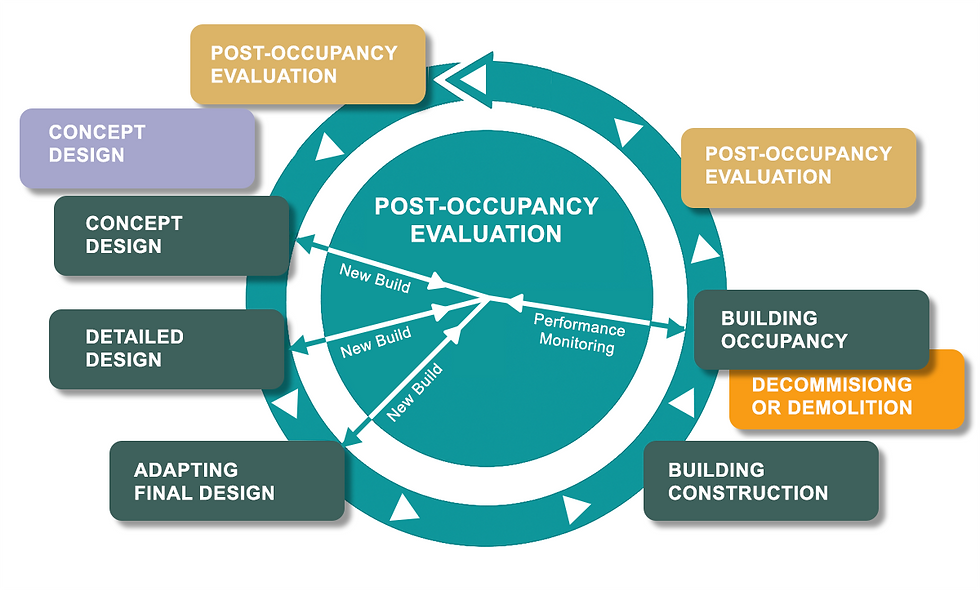

Performance optimization continues through months 43-60 and beyond, establishing continuous improvement protocols that maintain competitive advantage. Post-occupancy evaluation and adjustment based on resident feedback and operational data identifies enhancement opportunities and validates design decisions. Financial performance analysis and optimization ensures operating margins meet projections and identify revenue enhancement opportunities.

Future-Proofing: Industry Trends Reshaping Design

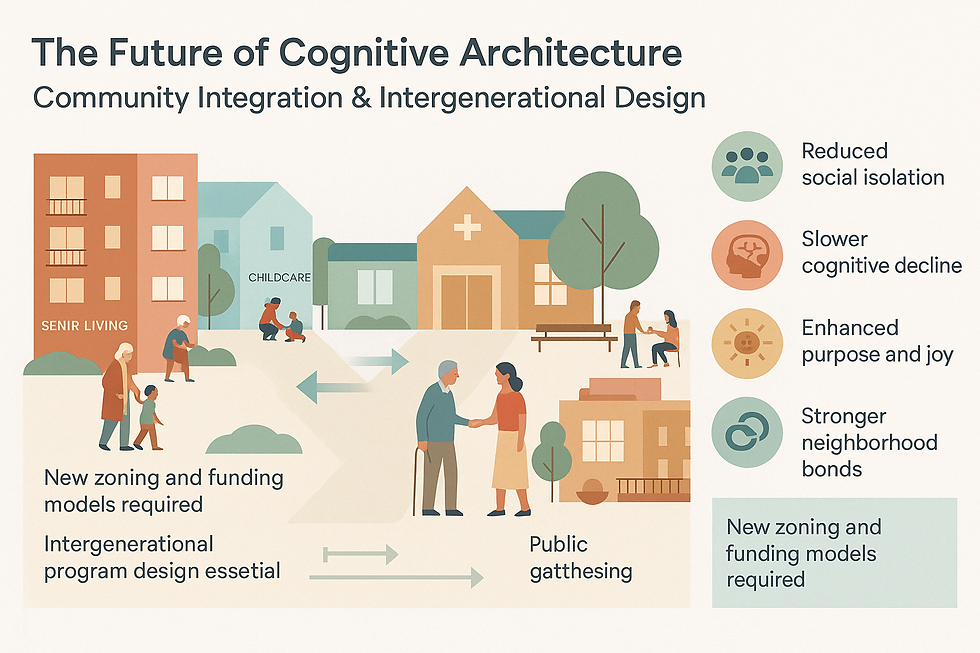

The CCRC industry faces unprecedented demographic and technological change that will reshape design requirements over the next decade. Population trends are reshaping market expectations as 73 million Americans over 65 by 2035 create both opportunity and competition pressure.

The $68 trillion wealth transfer from baby boomers to subsequent generations creates premium market opportunities for communities that understand evolving lifestyle expectations. Today's retirees expect hospitality-level experiences, integrated wellness programming, technology-enabled convenience, and environmental sustainability. Communities designed around these expectations will command premium pricing and waiting lists, while conventionally designed facilities struggle with occupancy and margin pressure.

Technology integration represents perhaps the most significant design challenge and opportunity. Digital natives entering retirement expect smart home features, integrated communication platforms, telehealth capabilities, and seamless technology experiences. The infrastructure required to support these expectations must be planned during initial design—retrofitting conventional buildings costs 3-4 times more and often compromises functionality.

Regulatory evolution continues reshaping facility requirements. Enhanced HVAC systems with minimum 6 air changes per hour in common areas reflect post-pandemic health consciousness. Infection control zones with separate air handling for healthcare versus independent living areas require sophisticated engineering and space planning. Technology requirements for telehealth capabilities in all units influence utility infrastructure and space allocation decisions.

Sustainability mandates are becoming standard requirements rather than optional certifications. California leads with 2030 net-zero energy targets, while water conservation requirements in drought-prone areas mandate 30% reduction compared to conventional facilities. Material health standards requiring low-VOC and sustainable specifications influence cost and sourcing decisions throughout projects.

The experience economy impact on senior living cannot be overstated. Modern residents expect restaurant-quality dining with multiple venues and chef-driven menus. Wellness integration requires medical, fitness, and spa services coordinated through sophisticated programming and space allocation. Cultural programming encompassing arts, education, and entertainment becomes essential for resident satisfaction and competitive positioning.

Performance Measurement: The Excellence Framework

Strategic design success requires measurement frameworks that extend beyond traditional occupancy and revenue metrics. The most sophisticated operators implement comprehensive performance monitoring that captures design's multifaceted impact on financial results, resident satisfaction, and competitive positioning.

Occupancy analysis must distinguish between gross occupancy rates and revenue-weighted performance. Communities achieving 95% occupancy with waiting lists demonstrate design excellence that supports premium pricing and market leadership. Monthly revenue per available room should exceed $4,000 in premium communities compared to $3,000-3,500 industry averages.

Resident satisfaction measurement requires sophisticated survey instruments that correlate specific design features with satisfaction scores. Independent living residents reporting 90th percentile satisfaction rates indicate design success that translates to referral generation and retention. Family satisfaction scores above 85th percentile suggest environmental design that supports care delivery and family confidence.

Staff retention rates above 90% indicate work environment design that supports operational excellence while reducing recruitment and training costs. Turnover rates below industry averages demonstrate design's contribution to staff satisfaction and operational efficiency.

Market positioning analysis examines competitive advantage sustainability and premium pricing power. Communities maintaining 6-18 month waiting lists demonstrate design-driven market differentiation that provides financial stability and growth options. Fee escalation rates exceeding inflation indicate design premium recognition and pricing power sustainability.

Financial performance measurement must capture design's long-term impact on operational efficiency, capital expenditure requirements, and asset value appreciation. Operating margins exceeding 25% in mature communities indicate strategic design's contribution to financial success. Capital expenditure requirements below industry averages suggest design quality that reduces maintenance needs and extends component life cycles.

The Strategic Imperative: Making the Case for Excellence

The evidence presented throughout this series builds an unavoidable conclusion: CCRC design is financial infrastructure that determines long-term success or failure. The communities that understand and implement this principle will dominate markets over the next two decades, while those that continue treating design as cosmetic enhancement will struggle with occupancy, margins, and competitive positioning.

The Rose Villa transformation demonstrates strategic design's transformative power. A failing 1960s campus became an award-winning, financially sustainable community through evidence-based design investment and phased implementation excellence. The project's success validates the strategic framework while providing a replicable model for similar transformations.

Industry data consistently supports strategic design investment. Entrance fee CCRCs outperform rental models by 4-5 percentage points in occupancy rates. Premium design supports 15-20% fee increases compared to standard facilities. Staff retention improves 23% in well-designed work environments. Energy costs decrease 15-25% through proper building orientation and systems integration.

The financial mathematics are compelling. Strategic design investment typically requires 3-5% additional development cost but generates 15-25% performance improvements across multiple operational categories. The return on investment becomes positive within 2-3 years and compounds throughout facility lifecycles that span 50+ years.

Market positioning advantages may provide the strongest argument for strategic design investment. Premium communities maintain waiting lists that provide financial stability and marketing leverage impossible to achieve through conventional approaches. Brand reputation built on design excellence creates referral networks and market presence that reduce marketing costs while supporting premium pricing.

The competitive landscape increasingly favors communities that understand design as strategic investment. As the baby boomer generation ages and wealth transfer accelerates, market expectations will continue rising. Communities positioned to meet these expectations through strategic design will capture disproportionate market share and financial performance.

For developers, architects, and capital managers, the choice crystallizes: invest in strategic design as financial infrastructure, or accept the ongoing costs of operational inefficiency, competitive disadvantage, and resident dissatisfaction. The communities opening today will operate for 50+ years. The design decisions made during development will impact financial performance throughout these decades.

The strategic framework outlined in this series provides the roadmap for success. From evidence-based design principles through technology integration, from regulatory compliance to performance optimization, every element contributes to sustainable competitive advantage and financial excellence.

The future belongs to communities that understand design as strategy, not styling. The question isn't whether strategic design investment delivers returns—industry data confirms measurable financial benefits. The question is whether organizations have the vision and expertise to implement excellence rather than accepting mediocrity.

The time for half-measures and cost-cutting approaches has passed. The market rewards excellence and punishes mediocrity with increasing severity. Strategic design investment represents the clearest path to sustainable success in an increasingly competitive and sophisticated marketplace.

The communities that embrace this reality today will lead markets tomorrow. Those that continue conventional approaches will struggle to compete with organizations that understand design's strategic power. The choice, and its consequences, become clearer with each passing quarter of performance data.

Excellence is not an accident. It results from strategic decisions, sophisticated implementation, and unwavering commitment to performance measurement and continuous improvement. The framework exists. The evidence supports investment. The only remaining question is whether organizations will choose to lead or follow in the transformation of senior living design.

Ready to implement strategic design in your next CCRC project? The experts at seniorliving.studio provide comprehensive design strategy consulting that delivers measurable ROI. Contact us to transform your vision into market-leading performance. long-term success or failure. The communities that understand and

Complete Source References

HUD Fair Housing Accessibility Wall Street Journal Publishes Our Editor Letter on CCRC Bankruptcies

She Paid $1 Million to Join a Senior Facility. Its Bankruptcy Wiped Her Out

Bankruptcy risk and state regulation of continuing care retirement communities

CCRC Performance: Entrance Fee Occupancy Surpasses 90% in 4Q 2023

CCRC Performance 1Q 2024: Occupancy Trends vs. Rent Growth Patterns

Construction Labor Challenges Push Senior Living Project Costs Higher in 2023

Cutting Costs, Not Care: How Robotic Food Servers Are Improving Efficiency in Senior Living

Best of CCRC Design 2016: Master Planning with Coastal Elegance

Rose Villa Transforms Senior Living Campus In Portland, Ore.

Rose Villa Senior Living, Portland, Oregon: EFA 2024 Design Showcase Award Of Merit

Senior Living Demand Surging, Setting New Record for Number of Occupied Units

New ASHA Report Details Baby Boomers' Seniors Housing Priorities

CCRC risk management: Navigating Regulatory Challenges